About

Partners Credit & Verification Solutions is a leading technology and services provider of credit related tools for lending institutions. We offer everything needed to assist the flow of consumer loans from initial approval to loan closing.

Credit score optimization tools

Tax and social security verifications

Verifications of employment

Verification of creditor and public record information

Quick score updates with credit bureaus

Automated valuation models for appraisals

Flood Zone Determinations

Fraud tools

BORROWER VERIFICATION REPORTS

VERIFICATION OF DEPOSITS AND ASSETS

VERIFICATION OF INCOME AND EMPLOYMENT

It allows any lending professional to securely transmit information from a credit report to a borrower for review. Expanding on a derogatory only report, a borrower is provided chosen elements to review for validity and provide feedback as to the status or accuracy of each item.

Public records

Inquiries

Addresses

Aliases

Provide credit report transparency to borrowers during a time of heavy CFPB scrutiny. Borrowers review their credit file for potential problems before rates or approvals are impacted.

Borrowers review online, so there is no printing, scanning, emailing or faxing, and our site is accessible via computer, tablet or smartphone. Feedback regarding their credit profile is input quickly and easily, and borrowers electronically sign the report when complete. Notification is then sent to the lending professional giving them quick access to the completed report. Report management is simple and allows for fast transition to further verifications or updating if necessary.

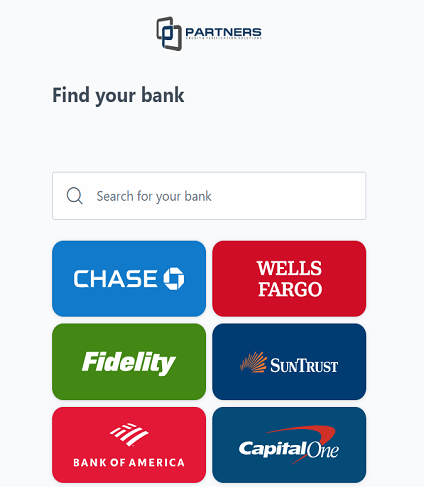

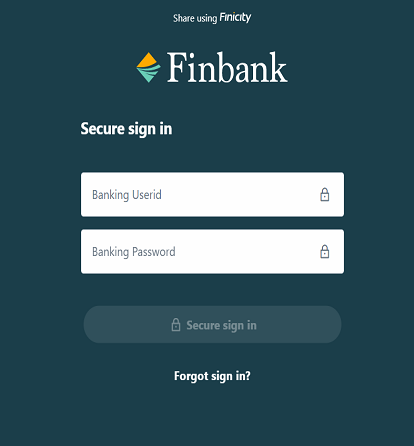

It works digitally to retrieve data directly from the source, the financial institutions. Traditional methods of requesting copies of statements from the borrower are a thing of the past, speeding up processes, and reducing the risk for fraud.

- How it works

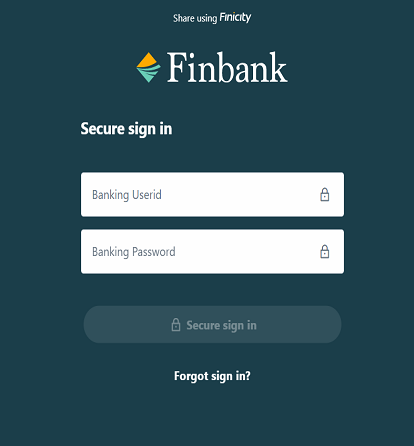

- Security We know that protecting a person’s personal information is paramount, which is why our platform utilizes bank-level security that encrypts information input by the borrower. This means that no one ever has the ability to see this information. Additionally, all information is purged from the system when data retrieval is no longer required.

Via our platform, borrowers authorize and connect to their financial institution accounts using their computer, tablet or mobile device. Once connected, the borrower is finished and we do all of the work, retrieving only required information for the loan, and compiling for easy review.

Optional refresh periods are available where lenders can retrieve the most recent data if existing data becomes out-of-date during the loan process, all without having to involve the borrower again.

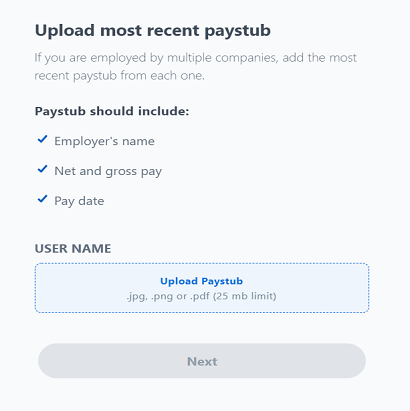

It works digitally and instantly, retrieving employer and income information directly from financial accounts where direct deposits are received. No need for contacting employers and sending forms to be filled out, all the while, reducing headaches associated with busy HR departments that don’t return needed information in a timely manner.

- How it works

- Security We know that protecting a person’s personal information is paramount, which is why our platform utilizes bank-level security that encrypts information input by the borrower. This means that no one ever has the ability to see this information. Additionally, all information is purged from the system when data retrieval is no longer required.

Via our platform, borrowers authorize and connect to their financial institution accounts using their computer, tablet or mobile device. Once connected, the borrower is finished and we do all of the work, retrieving only required information for the verificaion, and compiling for easy review.

Lenders receive the required report via their lending platform, and borrowers receive a copy of their completed report via our borrower online portal.

Borrowers should contact their lending professional if they have questions about the verification process or any of information being requested. Click the Support link above to contact Partners Credit & Verification Solutions regarding any technical concerns.